When things start going downhill, you should have a Plan B to fall back on. Just think about it. As a kid, you learned how to ride a bike by starting off with training wheels. You may have felt confident in your abilities to go without the trainers, but your parents knew that you needed them as backup in case things went wrong.

Similarly, for any organization looking to succeed and flourish, the solution lies in having an effective risk management process at the ready. This comes in the form of an enterprise risk management (ERM) framework, which involves mitigating risks before they wreak havoc on your company.

In this article, we will explore the key components of an effective ERM framework and the role of leadership in driving its success. Additionally, we will discuss how technology is reshaping the landscape of risk management and examine future trends in ERM.

What is risk management?

Your company is essentially playing a Monopoly game, where there are an abundance of risks and rewards at stake. Make one wrong move and you may end up in public relations jail. Invest all your funds into the right product and you just might end up passing ’Go’ over and over, as the company cashes in on its profits.

But how does your firm increase its chances of winning this game of Monopoly, when so many other businesses are also in the competition? Enter risk management, the meticulous process of identifying, assessing, and prioritizing potential risks that your business may face. While you are out there trying to ’win big,’ it’s equally important to develop strategies that mitigate these risks and protect your reputation, assets, and stakeholders.

Let’s get familiar with some key concepts:

- Risk appetite: The level of risk a company is willing to accept to pursue its strategic goals. Risk appetite is influenced by your industry, regulatory environment, and risk management capabilities.

- Risk tolerance: The acceptable level of variation in performance or results. Risk tolerance emphasizes the business’s ability to absorb and recover from difficult situations. A higher tolerance means that your company may be willing to take on higher levels of risk, while a lower tolerance suggests the opposite.

- Risk culture: The values, beliefs, and behaviors concerning risk within a company. Risk culture determines how risks are perceived, communicated, and managed throughout the organization. For example, a strong risk culture typically calls for transparency, accountability, and a proactive approach to risk management.

What does an effective ERM framework look like?

Now that you have a good idea of why risk management is necessary in the business world’s real-life version of Monopoly, it’s time to get into the nuts and bolts of an ERM framework. Its three basic components are described below:

1. Identify and assess risks

The first step in risk management is to identify and assess risks. Picture yourself as a doctor. If you don’t know what the problem with your patient is (risk), how can you diagnose the issue and come up with a treatment plan (risk response)?

During the risk identification process, you must conduct risk assessments via interviews, surveys, and data analysis. Take note of all types of risk — strategic, operational, financial, compliance, and reputational — along with any internal and external factors. For instance, operational risks could arise due to disgruntled employees who quit because of low pay, or when trade embargoes and plant shutdowns prevent work from getting done.

2. Risk response and control

After identifying and assessing risks, you’re ready to come up with a solution (similar to a doctor who prescribes medicine to sick patients).

At this stage, you should implement some control measures to minimize and combat the current risk. Here are several effective risk response strategies to keep in mind:

- Avoidance: To prevent situations from escalating, avoid risks by discontinuing certain activities or exiting a specific market. This will give you time to recover and reflect on what went wrong.

- Transfer: Consider transferring risks to third parties, such as through insurance or outsourcing. This will minimize the burden on your company, especially if it has already been dealt damage in terms of sales and reputation.

- Acceptance: When the possible benefits outweigh the potential negative consequences, you can choose to accept the risk. This works especially well in situations where your employees and stakeholders back you up.

3. Continuous improvement

Once you carry out your plan, don’t forget that what works today may not help tomorrow. Things always happen out of our control, whether it be a pandemic or an economic meltdown. Therefore, continuous monitoring and improvement is the only way forward.

For risk management to work its magic, your organization needs to monitor progress at all times. You can choose to conduct periodic risk assessments, review key risk indicators, or even analyze incident data. You may also train new employees on the risk management process and offer performance incentives that promote risk awareness and accountability.

How does great leadership affect ERM?

Now that you get what makes up an effective ERM framework, it’s time to pivot to leadership. As you know, success begins at the top, with a strong and knowledgeable person who can lead. When it comes to ERM, the chosen leader is often tasked with setting the tone for a risk culture and creating an environment where risks can be effectively managed.

Establish a risk culture

Transparency, accountability, and open communication — these three qualities are mandatory when it comes to leadership. In terms of risk management, leaders need to be honest and personable, so that their staff will feel comfortable reporting risks and raising any concerns. If leaders cannot gain the admiration and respect of their employees, it will be quite difficult for them to gain everybody’s cooperation. This can be very costly when an unreported risk ends up severely damaging the company, as it could have been dealt with if the staff knew the ’how’ and ’why’ of reporting potential risks.

Execute and monitor the risk response

When there are so many potential strategies that could lessen the looming risk, leaders must take it upon themselves to make the right decision. The risk response method of their choosing must align with the company’s overall objectives and match up with the resources at their disposal. Even if there appears to be one solution that is most popular with the staff, it may be impractical when applied or too costly considering the company budget. Remember, the business’s long-term growth and success must be the first priority.

After deciding which strategic approach works best and implementing it, don’t forget to track and analyze how effective the response is. If any more emerging risks, industry trends, or relevant information come into the picture, leaders should switch gears and adjust as needed.

How has technology influenced ERM?

Thanks to significant advancements in technology, the field of ERM has undergone quite the transformation. While risk management used to be done manually and relied on subjective assessments, today’s businesses have a wider range of tools and techniques at the ready.

Here are several resources that can help your company identify, analyze, and respond to risks in real time:

- Risk management software applications: A centralized platform to document and track risks across various departments and business units is a must for any business looking to maintain consistency in its risk management practices. This tool typically offers features like risk assessment templates, automated workflows, and customizable reporting capabilities.

- Data analytics: Collect, analyze, and interpret vast amounts of data with data analytics tools. You will be able to better identify patterns, trends, and potential risks so that your company can properly address the problems.

- Predictive modeling: This technique can simulate various scenarios and assess the potential impact of different risks. By running simulations and analyzing the outcomes, you come up with a better risk response.

Risks to watch out for

While technology has done wonders for ERM, it has also expanded the scope and complexity of risks that you may face. Let’s talk about cybersecurity threats, data privacy breaches, and disruptive technologies, and what your organization can do to protect itself.

- Cybersecurity threats: As businesses rely more on technology and data, they become vulnerable to cyberattacks. Whether these attacks come in the form of hackers or malicious spyware, your company needs to take action now. Try to incorporate regular vulnerability assessments and create incident response plans. Don’t forget to revamp your employee training programs and include content on cybersecurity risks.

- Data privacy breaches: With the implementation of data protection measures such as the General Data Protection Regulation (GDPR) in 2016, it has become more important than ever to handle and process personal data securely. Your business should include privacy impact assessments, data classification frameworks, and data breach response protocols at the ready.

- Disruptive technologies: Even though artificial intelligence, blockchain, and the internet of things (IoT) are making waves in the technology sector, they are also introducing new risks. Therefore, your organization should respond by taking the time to assess the impact of adopting these technologies and develop risk mitigation strategies.

Future trends in ERM

As the ERM field continues to advance, here are some future trends to keep an eye on.

- Predictive analytics: If companies can forecast future risks, they can get started on an action plan to address these issues immediately. With predictive models, you can identify patterns, trends, and potential risk factors before it’s too late.

- Cybersecurity: What do malware, phishing, and IP spoofing have in common? They are among several of many cyber threats that businesses of all shapes and sizes must contend with. Through continuous monitoring, incident response plans, and employee awareness programs, your organization can defend itself against cyber risks and protect all sensitive data from landing into the wrong hands.

Use Wrike to mitigate risks effectively

Make yourself a Plan B before others decide for you. In business, risk mitigation is an absolute must if you want to stay ahead of the game and protect your organization.

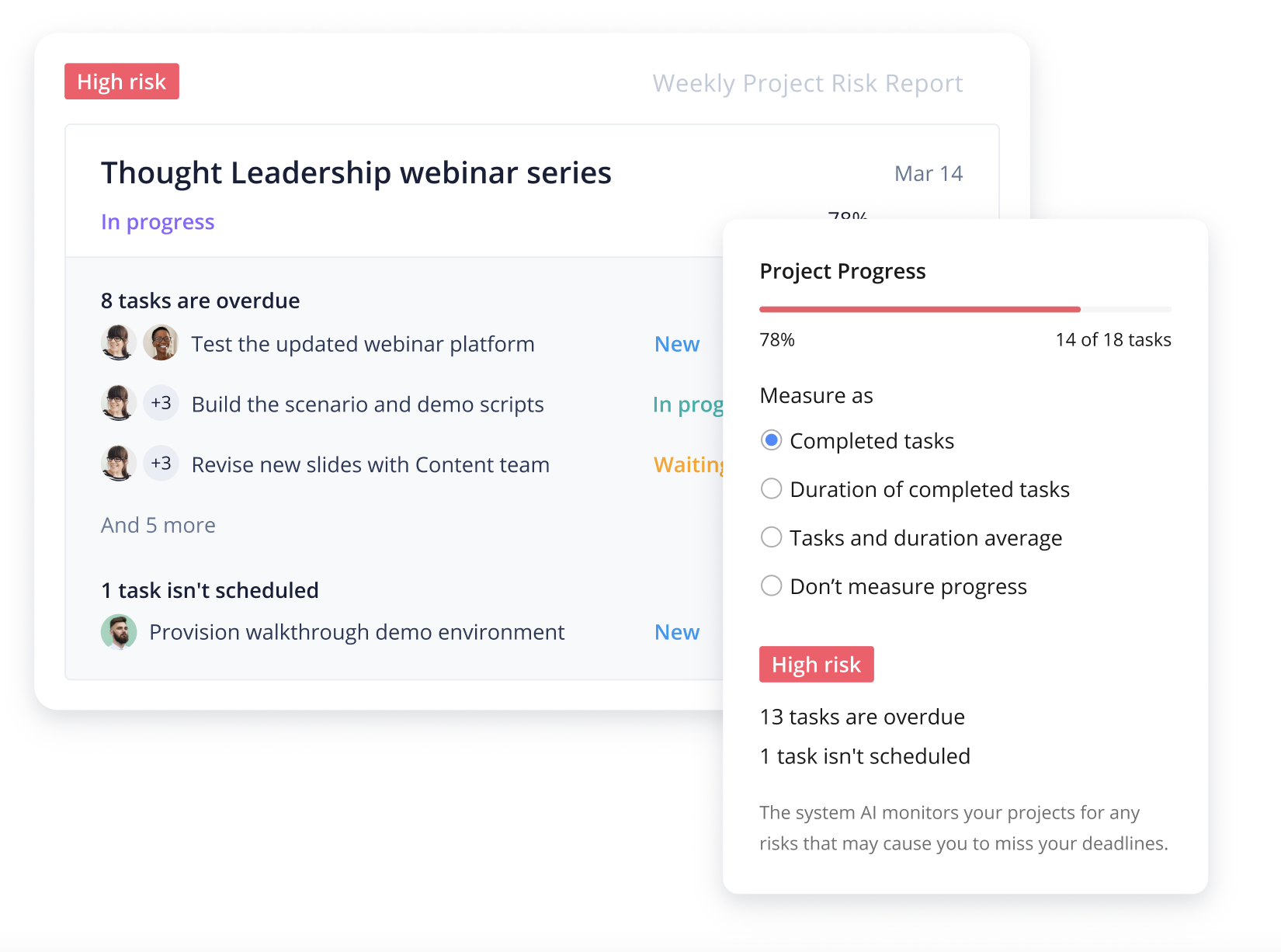

With Wrike, you can manage and track all your risk mitigation strategies in one place. You can even establish dedicated folders for different risk scenarios, maintaining a clear record of your strategies and their effectiveness.

Other risk management features include:

- Project risk prediction to monitor and assess risk levels

- Enterprise-grade security, including user authentication and data encryption

- Private spaces for executive-level projects

- Access roles to control user permissions

Have you come to the realization that your company needs a better way to manage risks more effectively? Say no more! Start your free trial of Wrike today.

Note: This article was created with the assistance of an AI engine. It has been reviewed and revised by our team of experts to ensure accuracy and quality.